Mortgage calculator for additional principal payments

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

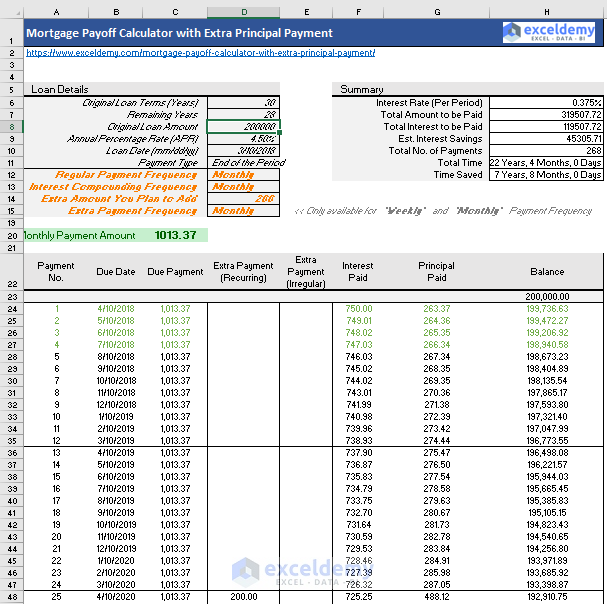

Mortgage Payoff Calculator With Extra Principal Payment Free Template

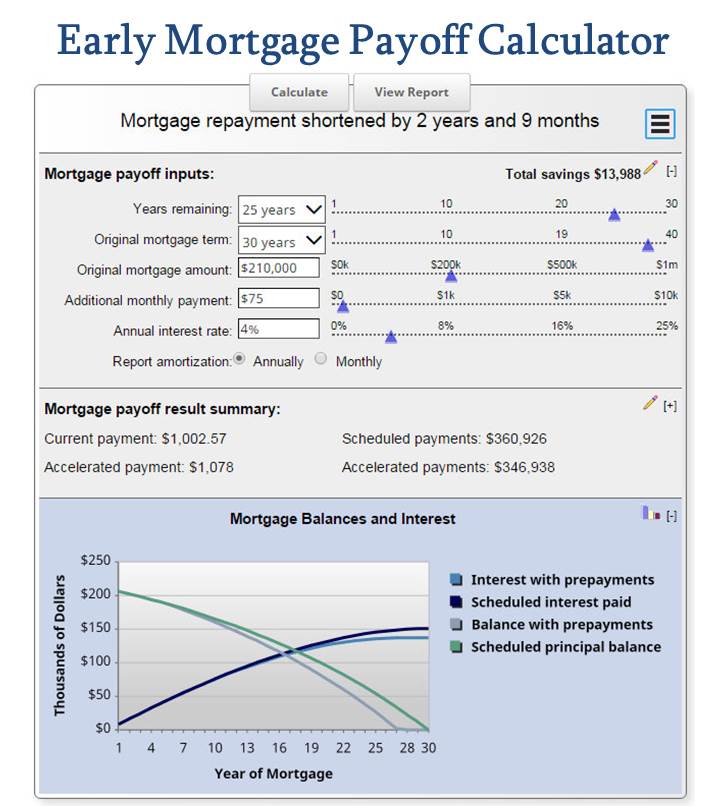

Additional mortgage payments have the biggest impact during the first years of the loan.

. Extra payments are additional payments in addition to the scheduled mortgage payments. VA loans do not require a down payment and most VA borrowers choose 0 down. And thats all it takes to use this mortgage.

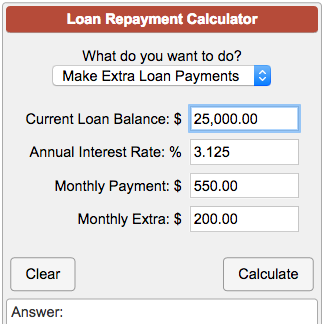

Borrowers can make these payments on a one-time basis or. If you want to add extra payments to your loan to pay it off quicker please use this calculator to see how quickly you will pay off your loan by making additional payments. A very big portion of the earlier payments will go towards paying down interest rather than the principal.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Our calculator includes amoritization tables bi-weekly savings. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan.

Cross-reference these values with your mortgage calculator. Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

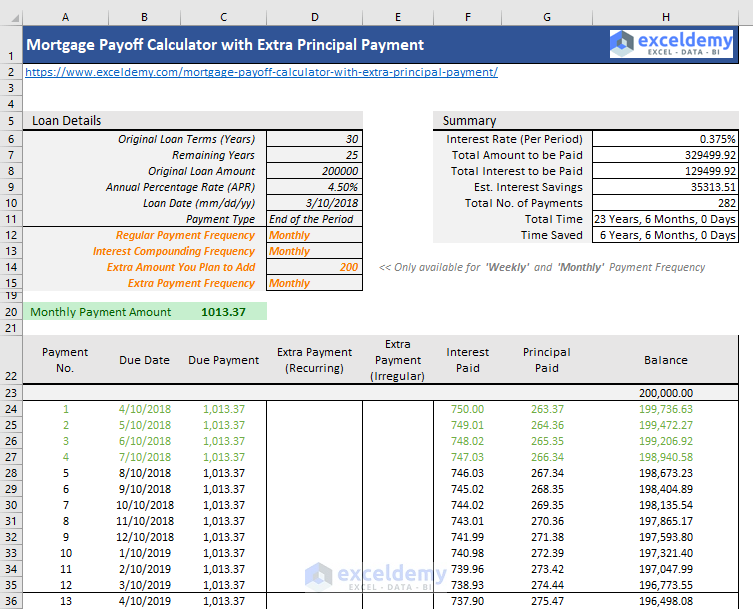

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options Lets say for example you want to pay an extra 50 a month. However that only happens after a certain.

You may think 50 or 100 a month is a small sum but no amount is too small. But before you make additional mortgage. Whatever extra you pay today is extinguished debt not accruing any further.

Thats a maximum loan amount of roughly 253379. Mortgage loan basics Basic concepts and legal regulation. For example you might make a payment on the 1st of the month and another payment on the 15th of the month.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Your payments should match the total cost of the loan from the mortgage calculator. Using the 250000 example above enter 50.

Any extra payments will decrease the loan balance thereby decreasing interest and allowing the borrower to pay. Why Early Extra Payments Matter. Enter your original mortgage information along with your extra payments using the calculator below to see how much interest you will save and how much sooner your loan will be paid off in full.

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. Building a Safety Buffer by Making Extra Payments. Check out the webs best free mortgage calculator to save money on your home loan today.

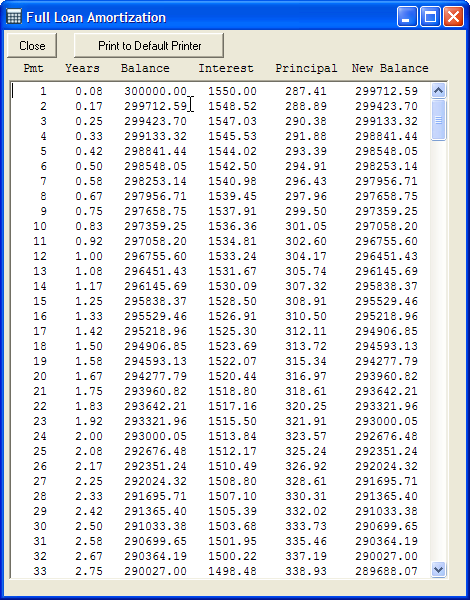

At the bottom of the table sum the payments interest and principal. Semi-monthly mortgage payments split every month into two. Enter your loan information and find out if it makes sense to add additional payments each month.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Enter amount Please enter an amount for additional payments that is greater than 000 and less than the mortgage amount. However if you decide to put money down it can reduce the VA funding fee - if required - and your.

With a semi-monthly mortgage payment your mortgage payment will be made two times per month. How to estimate mortgage payments. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan.

Our mortgage calculator contains BC current mortgage rates so you can determine your monthly payments. Then input the additional payment amount and whether itll be a monthly annual or one-time extra payment. If they match youve done the formulas correctly.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This is the purchase price minus your down payment. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half.

It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan. Additional payments to the principal just help to shorten the length of the loan since your payment is fixed. BC Mortgage Calculator Location Please ensure your location is correct in order to find the best rates available in your area.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. 100 per month. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments.

The earlier you. Most loans can be categorized into one of three categories. The down payment is an upfront amount paid towards the principal.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. This is because the principal or outstanding balance is larger.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Our calculator also includes mortgage default insurance CMHC insurance land transfer tax and property taxes. Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years.

Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. The VA loan calculator below provides your estimated monthly mortgage payments with a VA loan. Principal and Interest of a Mortgage.

30-Year Fixed Mortgage Principal Loan Amount. Mortgage calculator - calculate payments see amortization and compare loans. This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Your principal should match up exactly with the original loan amount. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Fixed payments paid periodically until loan maturity. Semi-monthly mortgage payments are not the same as bi-weekly mortgage payments. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

Of course paying additional principal does in fact save money since youd effectively shorten the loan term and stop making payments sooner than if you were to make the minimum payment.

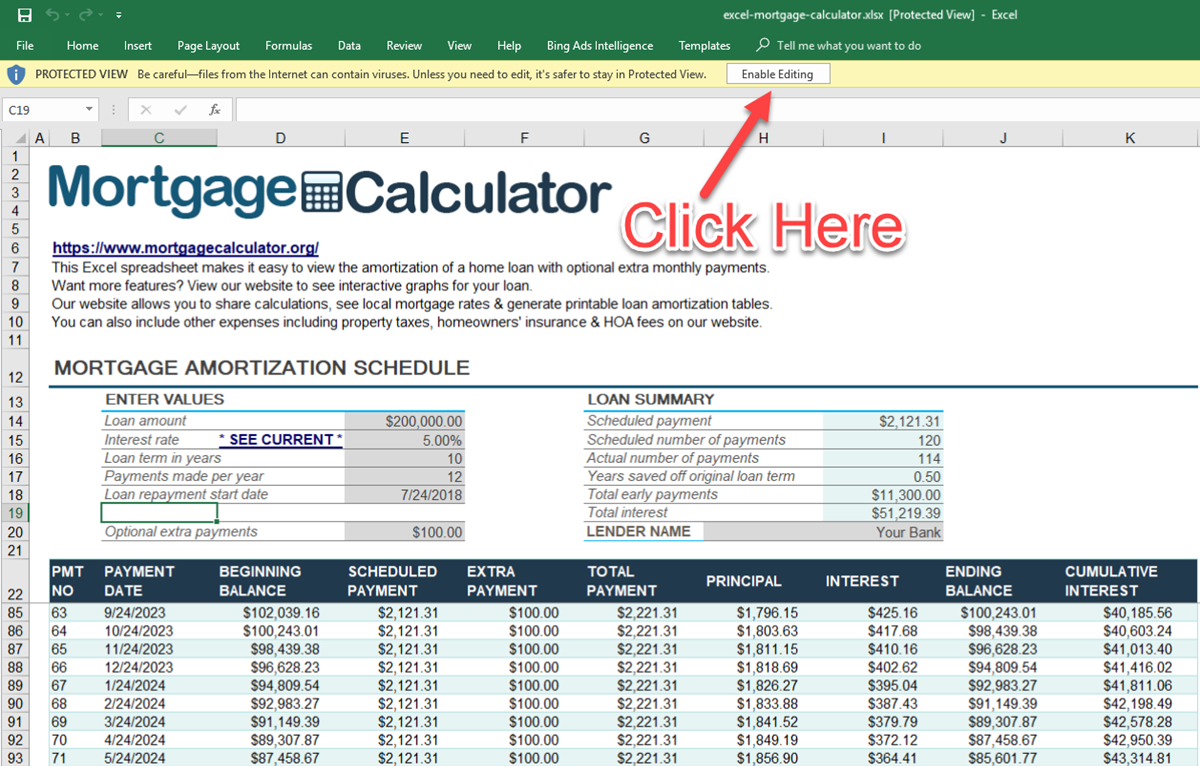

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage With Extra Payments Calculator

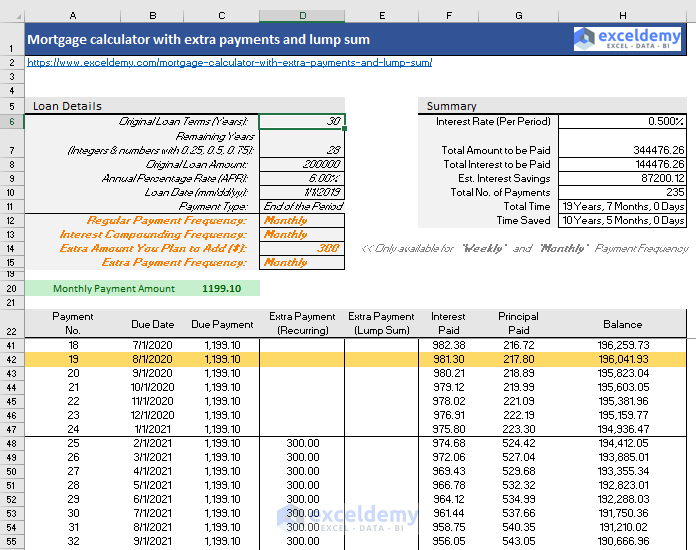

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Payoff Calculator With Line Of Credit

Loan Repayment Calculator

Extra Payment Mortgage Calculator For Excel

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Mortgage Payoff Calculator With Extra Principal Payment Free Template

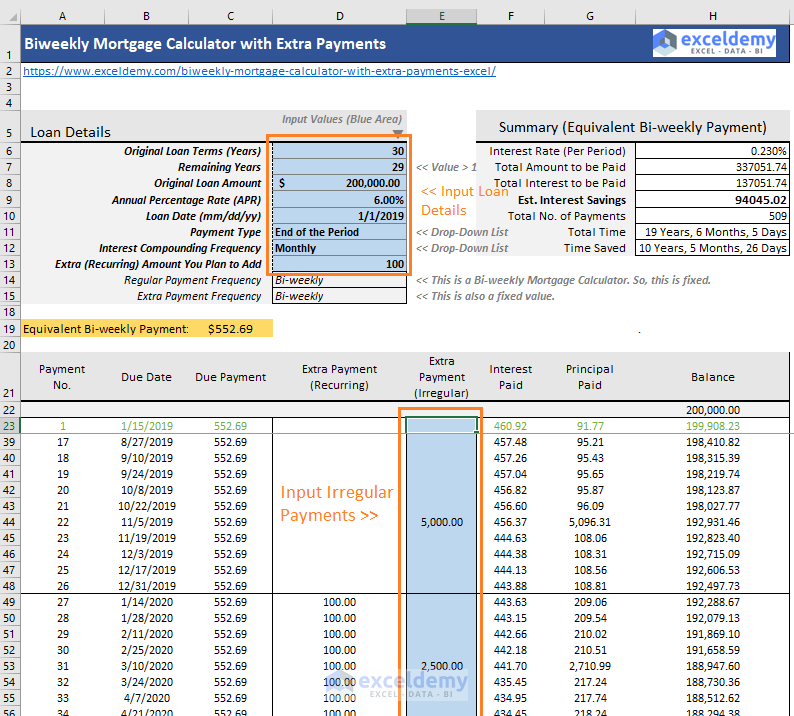

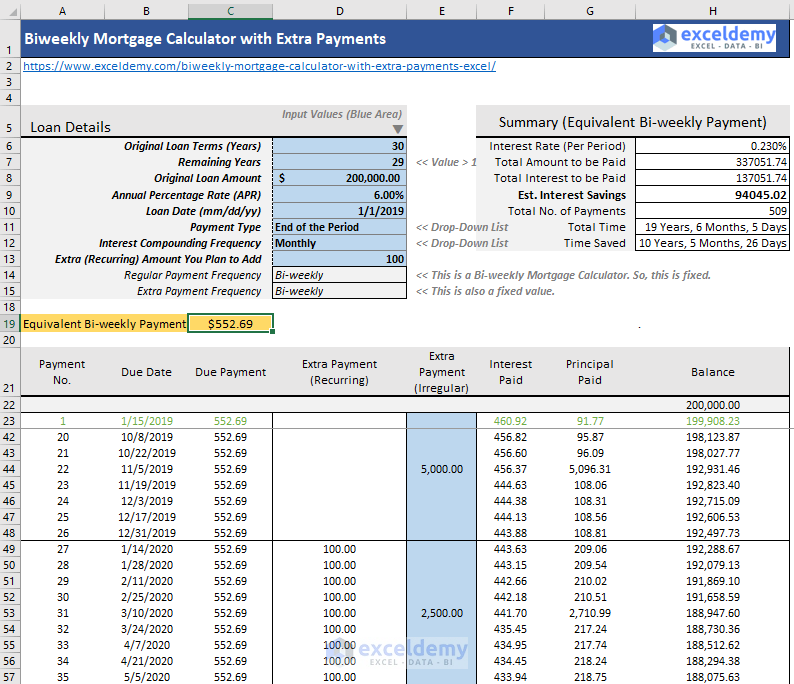

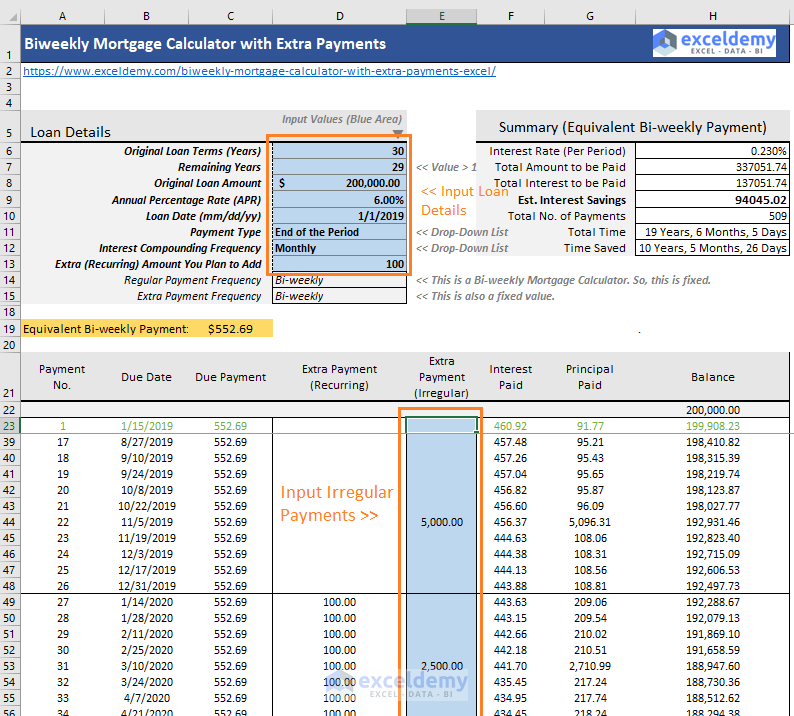

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Interest Only Loan Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Extra Payment Calculator Is It The Right Thing To Do

Downloadable Free Mortgage Calculator Tool